Presentation

Download the presentation (PDF 5.1 MB)

Download the podcast (MP3 45 MB)

Transcript

View the 2022 Q4 and full year results presentation and read the transcript slide by slide.

Download the presentation (PDF 5.1 MB)

Download the podcast (MP3 45 MB)

View the 2022 Q4 and full year results presentation and read the transcript slide by slide.

And thank you very much, operator. And thank you to everybody for participating on what is a very busy day for reporting in pharma, European pharma.

Before we start, just reading the safe harbor statement. The information presented today contains forward-looking statements that involve known and unknown risks, uncertainties and other factors. These may cause actual results to be materially different from any future results, performance or achievements expressed or implied by such statements. For a description of some of these factors, please refer to the company's Form 20-F and its most recent quarterly results on Form 6-K that respectively were filed with and furnished to the US Securities and Exchange Commission. And with that, I'll hand across to Vas.

Thanks, Samir, and thanks, everyone, for joining today's conference call. I really appreciate your interest in the company and our update for the full year 2022.

If we move to Slide 4, this year, as you saw in our earnings release on 2022, we delivered what we believe is really robust core operating income growth and margin expansion. From a sales standpoint, you saw Q4 sales up 3%, with IM delivering Q4 sales at 3% and flat Sandoz sales.

Productivity standpoint, we had a 15% core operating income growth in quarter 4, and Harry will go a little bit further through the dynamics that drove that.

But for the full year, that led to 8% core operating income growth ahead of our guidance. And that leads us to have now a margin, for IM in quarter 4, of 36.4%, and on the full year, 36.9%. And as a reminder, taken together, inclusive of corporate costs, we are well on our way now towards our 40% core margin guidance for the medium term.

Now in terms of innovation, some important milestones, we'll go through those in a bit more detail. And we continue our journey on ESG sustainability-linked bond. We continue to progress towards our 2025 targets. We had 31 million patients in our Novartis flagship programs, and we continue to have solid ratings across the key ESG rating agencies.

Now moving to Slide 5. You'll remember that in September at our Meet the Management, we rolled out our new focused strategy, and we've been diligently been implementing this across the company: 5 core therapeutic areas, 2 plus 3 technology platforms, 4 priority geographies, a mindset to really focus on high-value medicines to accelerate growth, delivering the return profile we believe the company can achieve, and you saw that already in quarter 4 and a continued commitment to culture, data science and building trust with society.

Now moving to Slide 6. And as a reminder, as you all well know, over the last 5 years and really over since 2014, we've been on a journey to really focus Novartis as a pure-play innovative medicines company. And through a number of actions we've taken, most recently with the announced planned spin-off with Sandoz, we're on our way to becoming a 100% innovative medicines company.

And when you look at the right-hand side of the slide, we believe that a simplified organizational model will allow us to have greater focus, leverage our scale and really uniquely position us as a global pure-play, large-scale innovative pharma company versus our peer set. And over time, hopefully, also re-rate the company given the growth profile we intend to deliver.

Now moving to Slide 7. We've also guided to improve financials with this new focused company, with 4% sales growth; a goal of core operating income margin of 40%, as I previously stated; continued improvement on free cash flow; and importantly, an improving and attractive return on invested capital profile. That will allow us to continue to invest across our capital allocation priorities, which Harry will go through in a bit more detail later on in the presentation.

Now moving to Slide 8. In each of the 5 therapeutic areas that we've outlined, we have core large-scale commercial assets and have multiple pipeline assets that are now progressing. And we focused our R&D organization around these 5 areas. We're streamlining the pipeline. I think you'll see over the coming quarters us exiting additional assets as we really try to prune out non-core areas, and put all of our scientific firepower and ingenuity towards building out a deep set of pipeline assets in each of these therapeutic areas. We'll look forward to showing that progress over the coming year.

Then moving to Slide 9. In terms of capital allocation priorities and the strong balance sheet that we have, continue to invest in the organic business and pursue value-creating bolt-on, we look at the full range of M&A possibilities, but our focus is on sub-USD 5 billion assets, where we believe we have the opportunity to generate strong returns and find the most value when we look at M&A opportunities.

And we also remain committed to our growing our annual dividend, and Harry will outline that in a little while. But we have paid out USD 7.5 billion in 2022. Our proposed dividend is another growth in the 3.2% Swiss franc and 3.9% US dollar range. And even after the proposed Sandoz spin-off, there will be no re-basing of that dividend. We'll continue to grow off of the current base. And we're continuing to implement our USD 15 billion share buyback program. We have USD 4.9 billion still to be executed. And we'll continue to look at doing additional share buybacks over the coming years when the opportunities present themselves.

Now moving to Slide 10. And I want to turn now to our innovation story and where we are and continuing to improve our overall R&D productivity. I think it's been well recognized, we are a leader in terms of generating approvals, the leading company over the last 20-plus years in generating drug approvals in the United States and around the world. Our focus now is to improve the value per asset, identifying assets earlier that have significant potential, investing in those assets more aggressively, pursuing more life cycle management indications.

And with that, a goal to increase the success rate and reduce the cycle times and generate larger assets. Maybe not winning the game of generating the most assets, but really focused on high-value, high-impact medicines that could impact patients and the company's financial performance.

Moving to Slide 11. I wanted to walk through some of the readouts that we have coming up in the near term and then in the midterm. Now I think as you all are well aware, Kisqali® continues on track. We'll go through this in a bit more detail in a few slides for a readout in the second half. Iptacopan is progressing nicely, with multiple readouts over the course of this year, a planned FDA submission in PNH and then readouts in both IgAN and C3G.

And then Pluvicto®, where we've already read out the top line in the early prostate cancer, early metastatic setting with a planned regulatory submission in the second half. And I'll give you a bit more detail on each of these 3 in a few slides.

But going to the next slide. When you look at '24, '25, we expect to have an increased pace of readouts of potential multimillion-dollar medicines. Medicines such as pelacarsen in outpatients with elevated Lp(a) level. Ianalumab, where we have now moved this medicine into multiple hematological indications, first and second-line ITP readouts in 2025. We have additional hematology and immunology indications we're pursuing now with this medicine. So you'll see with ianalumab a broad range of Phase III programs initiating over the coming periods.

Remibrutinib, we have a CSU readout in 2024 ahead of our planned MS readouts in the coming years. And then we continue to progress with – at OAV-101, which is our gene therapy for SMA in the intrathecal setting, as well as the first-line Scemblix® program with a readout planned in 2024.

Now moving to Slide 13, and going into a bit more detail. NATALEE continues to progress well following the first interim analysis, and we continue to guide to a final readout in the second half of 2023. As a reminder, this is a broad population, including both Stage 2 and Stage 3 patients, so the broadest population study to date. We have longer duration with which we provide therapeutic to patients, 3 versus 2 years, a lower dose to try to improve the overall tolerability profile.

And when you look at where we are in the study, final analysis is expected with 500 iDFS events at the end of 2023. We've completed the first interim analysis as we noted earlier this month, and study continues unchanged. The second interim analysis would happen after 85% of iDFS events are complete.

Now moving to Slide 14. And turning to Pluvicto®, where we announced late last year that we demonstrated statistically significant and clinically meaningful radiographic PFS benefits in this patient population. Now we're continuing to follow these patients with the second – towards the secondary OS endpoint analysis in 2025. We plan – are on track to file in the second half of this year.

We have had discussions with the FDA and clarify the OS fraction. The fraction of patients that FDA would like to see has reached an OS endpoint prior to filing. We expect to reach that later around the middle of this year, which would then enable the filing in the second half. Now with that guidance from FDA, we've made the decision to hold the publication or presentation of further data until the second half of this year.

I know some of you have been looking for ASCO GU and some of the other congresses in the first half, we will be presenting this data in the second half after we've reached that next threshold that FDA has outlined for us. We have alignment then consistent with what FDA has told to other companies in the prostate cancer space, to then be able to file in the second half with that data set.

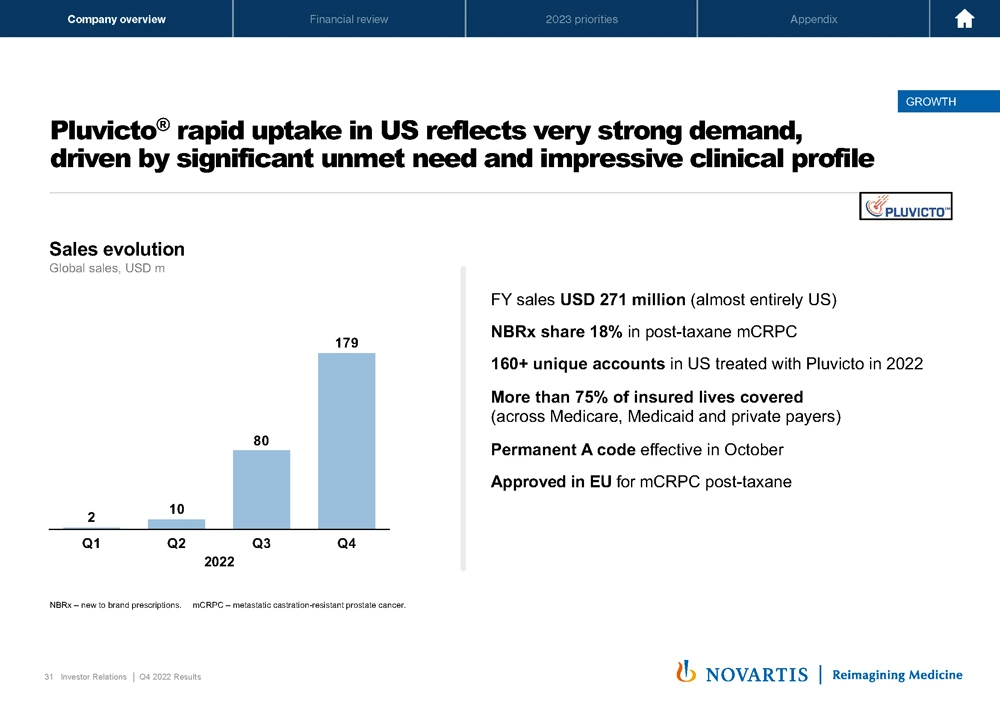

Now moving to Slide 15. And why that's so important is, as I'll talk about that when we get to the commercial section of the presentation. Pluvicto® is continuing to demonstrate, I think, really impressive uptake in the United States market. And the opportunity is to move first with the PSMAfore study into the pre-taxane setting, which would expand the patient pool from an estimated 27,000 patients to 42,000 patients. Then with the PSMAddition study, which we expect to read out next year, that would expand us further into the hormone-sensitive setting.

And then we continue to evaluate how best to pursue Pluvicto® further into the biochemical recurrence setting or the localized prostate cancer setting. So stay tuned as we continue to look at the further expansion. But I think this really demonstrates the possibilities of radioligand therapy, and we look forward to continuing to generate a broad set of data to support Pluvicto®'s use in as many prostate cancer patients that could potentially benefit from the medicine.

Now moving to Slide 16. Turning to iptacopan, and as I noted in the second half of last year, we first provided an update that – and provided the full data set at ASH, the APPLY data set, which I think showed really outstanding efficacy for all primary – for both primary and secondary endpoints, superiority to standard of care in patients with residual anemia.

In the Phase III APPOINT study, where we have demonstrated, again, us really strong results, and we'll be presenting that data at a congress in the first half of this year. And then we continue to progress across a range of indications, IgAN and C3G, which will read out in 2023; atypical hemolytic uremic syndrome, where we expect the submission enabling readout in 2025. And then a number of other indications, IC-MPGN, lupus nephritis, immune thrombocytopenia, amongst others.

Moving to the next slide. And just as a reminder, when you look at the data set that we showed at ASH, I think very impressive data in these patients with residual anemia, some of the notable data when you look at increase in hemoglobin from baseline 51 out of 60 patients versus 0 out of 35, so 82.3% versus 2% against the control arm. Hemoglobin greater than 12, similarly impressive results, 42 out of 60 versus 0 out of 35. Again, transfusion avoidance, you can see an impressive 70.3% improvement and a tenfold lower rate of annualized clinical breakthrough hemolysis.

So this is in that refractory setting. We'll present the data in the frontline setting. We've also initiated a study of patients who – to demonstrate we can switch off of the MPC5 directly on to iptacopan in patients in that frontline setting. So building out a broad data package within PNH.

Now moving to Slide 18. We wanted to also provide a little more clarity on our approach within IgA nephropathy. In this – sorry, this is still in PNH, excuse me. So – and this is the outline of the data set for APPOINT where we'll present this data shortly. And you can see again the design of the study has the potential to be practice-changing in PNH. And as I said, we'll be looking forward to outlining this primary endpoint and secondary endpoint in an upcoming congress.

Moving to Slide 19. Now turning to the IgAN study APPLAUSE for iptacopan, we wanted to clarify that our current filing plan aligned with the FDA, that's a 9-month analysis, to assess superiority in reduction of proteinuria at 9 months. A statistical plan has been agreed. This would support a US Subpart H approval for accelerated approval. We would then continue to follow these patients to look for the more definitive endpoint and to look at flowing progression for IgAN, which would take to the end of the study in 2025, enabling the approval to convert to a full approval. So that's the approach we'll take with IgAN, and we'll look forward to sharing that data towards the end of this year.

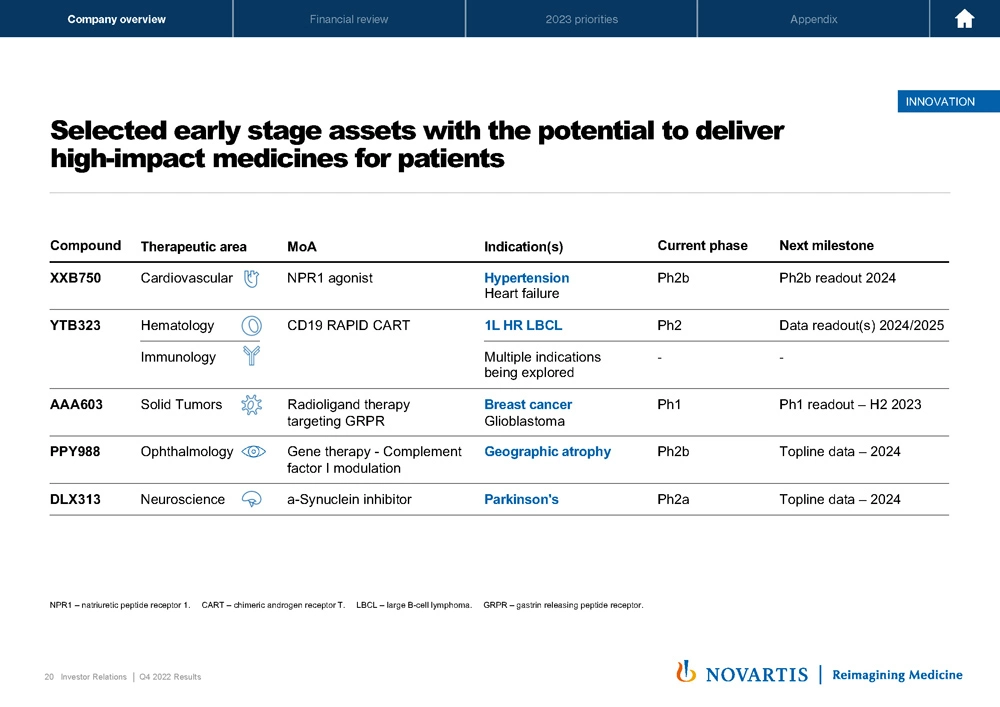

Now moving to Slide 20. I did want to highlight a couple of earlier-stage assets where we're continuing to progress now really with a focus on large potential assets in the pipeline. These include drugs like XXB in cardiovascular disease. This is an NPR1 agonist given infrequently a monoclonal antibody for resistant hypertension and heart failure. YTB, our T-Charge platform, where we presented additional data at ASH, where we are now pursuing this both in the front line large B-cell lymphoma, but importantly, also in multiple immunology indication on the back of data, suggesting that we can take refractory patients into remission, at least in small-scale studies, and that's something we're looking at more carefully.

Additional radioligand therapies, including in breast cancer and glioblastoma. PPY, which is our gene therapy in ophthalmology for geographic atrophy, which we acquired as part of the Gyroscope acquisition. And lastly, DLX, the partnered compound analysis, oral a-Synuclein inhibitor for Parkinson's disease. All high-risk projects, as is always the case in the stage of development, but all with the potential if they were to work to be very transformational medicines.

Now moving to Slide 21. Now turning to the growth profile of the company and why we believe we can deliver that 4% growth. We have these 6 in-line brands, these 3 major launch assets, Pluvicto®, Scemblix® and iptacopan, and these additional pipeline assets that I've outlined. And that's why we continue to believe that we have the firepower in-house with the assets we have to be able to generate that 4% growth, with that 40% margin and create a very attractive profile in the coming years.

Now moving to Slide 22. The drivers of our growth in this year or this past year were primarily Entresto®, Kesimpta® and Kisqali®, with major contributions from Pluvicto® as well as, to a lesser extent, Scemblix® and Leqvio®. And we expect that those assets to continue to have robust growth over the coming years. Now importantly, we'll discuss a bit more detailed Cosentyx® and some of the dynamics there. But the critical element for our Cosentyx® story will be life cycle management and the next wave of indications, as well as continued growth in Europe and China, and I'll go through that in a moment.

Now moving to Slide 23. When you look at Entresto®, continued strong performance, 44% growth quarter-on-quarter. You can see the US weekly TRx continue to climb, demonstrating that Entresto® really now is the treatment of choice for patients with heart failure, meeting the guidelines within the label and the relevant cardiovascular guidelines. You see the NBRx is up 16%. We continue to see strong growth in Europe. In China and Japan, we also have contribution from intrusive use and resistant hypertension. And we remain confident in the ongoing growth profile as we continue to penetrate in heart failure, continue to generate additional real-world data, and we see that launch momentum in Asia as well.

Now moving to Slide 24 and turning to Cosentyx®. I think as many of you have already seen, Cosentyx® Q4 sales were impacted by a revenue deduction true-up related to prior quarters. This was related to a higher level of Medicaid utilization than we had expected. This is a delayed data that we receive from the various Medicaid channel sources. And that led to a higher revenue deduction for the previous quarters, which we took fully in quarter 4.

When we fully neutralize for that, we saw the US actually declined 6%. And when we look at all of the puts and takes, we see the US largely being in line right now with respect to Cosentyx® performance in 2022 versus the prior year. We would expect, in the US for 2023, to continue to see in line growth. So that's – when we look at all of the dynamics, you will see in the first half of the year some declines in Cosentyx® as we lap the fact that in the previous year you had these deductions, which were not factored in.

But underlying, we expect Cosentyx® to be able to hold its current performance in the US. And then growth that really enables us to get to that mid-single-digit growth will be driven by Europe and China, where we continue to see strong growth – double-digit growth in China overall. And that will enable us to be well set up for what will come next, which is primarily the life cycle management of this brand.

And turning to life cycle management. When you go to the next slide, Slide 25, really for Cosentyx® now to continue its trajectory to get to the USD 7 billion, which we remain confident in, it will be around launching these next wave of indications successfully. For Hidradenitis Suppurativa, we expect the approvals in Europe in the first half of this year and in the US in the second half of this year. This is a large indication where only one competitor product is approved, the TNF. So we'll be first to market as a novel agent in this whole setting. And so it's an exciting opportunity to bring this new therapy to this patient population.

We have the intravenous US launch, where we'd be the first novel post-TNF medicine to be available in an intravenous formulation. We expect that launch in the second half of 2023. A new auto-injector. And then the continued work we have on giant cell arteritis and lupus nephritis, again, indications where Cosentyx® has generated, I think, compelling data. So taken together, when we look at this profile for life cycle management, the profile we have ex US and the stabilization of the US business, we feel confident we'll get to that USD 7 billion peak sales potential over time.

Then moving to Slide 26. You saw that Kesimpta® is continuing its strong growth trajectory with 28% constant currency growth, primarily driven by the US, though we now start to see a pickup as well outside the United States. Importantly, the key driver for this is the ongoing utilization of Kesimpta® in patients who were previously on braces or were naive to any multiple sclerosis therapy. It's important to note that in the B-cell share of the total market is only about 50%. So half the market continues to receive older therapies.

Our Kesimpta® exit share was 30%, and we plan to continue to grow that with a goal to get to 50% share of B-cell patients over time. So really good efficacy profile, strong convenience profile. So we'll continue to look forward to launching Kesimpta® around the world and driving that dynamic US performance.

Now moving to Slide 27. Kisqali® had strong growth across all geographies. And when you look at that 33% growth, that's driven by a recognition that Kisqali® really is the agent with the best data sets in the metastatic breast cancer setting today. And that's, I think, been really captured by the NCCN guideline update that happened just a few days ago, where Kisqali® was named the only Category 1 treatment for first-line metastatic breast cancer patients with an aromatase inhibitor, which is the majority of patients in the metastatic setting.

So with that NCCN guideline update now and as we continue to communicate that to physicians, this hopefully will give us continued momentum, as you can see with Kisqali® now getting to 27% in NBRx share. And hopefully, we'll see in that metastatic setting, that continued climb on the back of the data sets that we've presented, NCCN guidelines, broad momentum coming out of the San Antonio Breast Cancer Congress as well.

And then that will flow into, of course, the NATALEE readout, which we've already discussed, and the ongoing HARMONIA head-to-head study we have ongoing versus Ibrance®. Notably as well, we did achieve an approval in China for Kisqali®, which will be another growth driver for this brand going forward.

Now moving to Slide 28. Zolgensma® maintained the leading share in patients with SMA less than 2 years of age. But Q4 growth was muted, and this was really because we've now penetrated a lot of – most of the bolus and not the entire bolus, the prevalent patients in most of our key geographies. And growth now is largely dependent on adding additional countries in emerging markets around the world. And so we expect with this brand to stabilize in the USD 1.5 billion range until we get the readout and hopeful approval in the intrathecal setting.

We'll continue to work to increase newborn screening. Importantly, in Europe, that's at 45%, and we have the opportunity, we believe, to drive that up further, it could be a source of growth as well as adding on additional markets in Latin America, the Middle East and other parts of the world. But the key next inflection point for Zolgensma® will certainly be the readout of the STEER study of intrathecal patients and the STRENGTH study in the use of IV Zolgensma® patients in 2 to 5 years of age. Those studies are enrolling on track, and then we'll hopefully have data sets to share in the coming years.

Moving to Slide 29. I wanted to turn to Leqvio® and give you an update on where we are now as we continue to build a strong foundation for this brand to become a significant cardiovascular medicine for the company. With respect to access, we're now at 76% of patients covered at or near label. In terms of adherence, we're seeing 75% of patients today coming in for their second dose. We now have 1,700 centers that have ordered Leqvio®. And we've been able to increase between Q3 and Q4 about 50%, the number of HCPs who prescribed Leqvio® either through a paid dose or through our free trial offer to now 7,200 physicians.

So we continue to build that strong base, continue to generate important data. The ORION-3 data was recently published. Our Phase III secondary prevention studies are enrolling well. We've launched now our primary prevention studies, which we'll expect to start in the first half of 2023 and continue to build out a robust data set for this medicine.

Now moving to Slide 30. When you look at where Entresto® is and compare it to where – sorry, where Leqvio® is and compared to where Entresto® was in the US, we're largely in line with what we saw in the Entresto® launch. A slow ramp as we build up awareness amongst physicians, get all of the various elements in place and really build momentum in the cardiovascular community for use of a new medicine or, in this case, a new approach to controlling cholesterol. So we're on track versus the Entresto® ramp, and that's the ramp we would expect to see over the course of the coming months with respect to Leqvio® with a goal, of course, to accelerate wherever we can.

When you look at the US, the key accelerators are going to be new facilities getting more depth in our existing prescribers, and continuing to educate HCPs is on the Part B reimbursement process. We also would expect, over the course of this year, to get additional conversion from the free trial offer that we rolled out in the second half of last year.

Outside the United States, a big focus at the NHS is to get a broader prescriber breadth in the UK. And then we'll have the hopeful approval in the back half of this year in China, which will allow us to have a major geography where we can further accelerate global Leqvio® performance.

Moving to Slide 31. Pluvicto®, I think, as you've all seen, is off to an outstanding start in the United States. And this is reflective of very strong demand we're seeing for this medicine. USD 179 million in quarter 4, full year sales of USD 270 million, almost entire – all of that was in the US. We are seeing NBRx share at 18%, and that continues to climb in the post-taxane mCRPC setting, 160 unique accounts. We have very good payer coverage, permanent A code is now in effect. We're approved in Europe.

So this is a story now where we continue to see very strong demand in the US, and we see strong demand in Europe, and we're scaling our manufacturing capacity to meet that demand.

And when you look at the next slide, our Pluvicto® manufacturing capacity is going to expand over the course of 2023. Our expectations are we'll be able to move across 4 facilities that will have online for this medicine versus a single facility right now that's the primary source areas today. We're working hard to bring Millburn online by the middle of this year, which will allow us for another capacity expansion.

Then later this year an automated, brand-new facility in Indianapolis with substantial capacity. And then for the rest of the world, Zaragoza facility in Spain, which would then further expand our capacity for Europe. We're also evaluating adding additional manufacturing sites in Asia at this time. With the 4 facilities you have here, we're targeting capacity of over 250,000 doses annually in 2024 and beyond. And then we'll continue to expand that capacity by adding additional facilities if the demand warrants it.

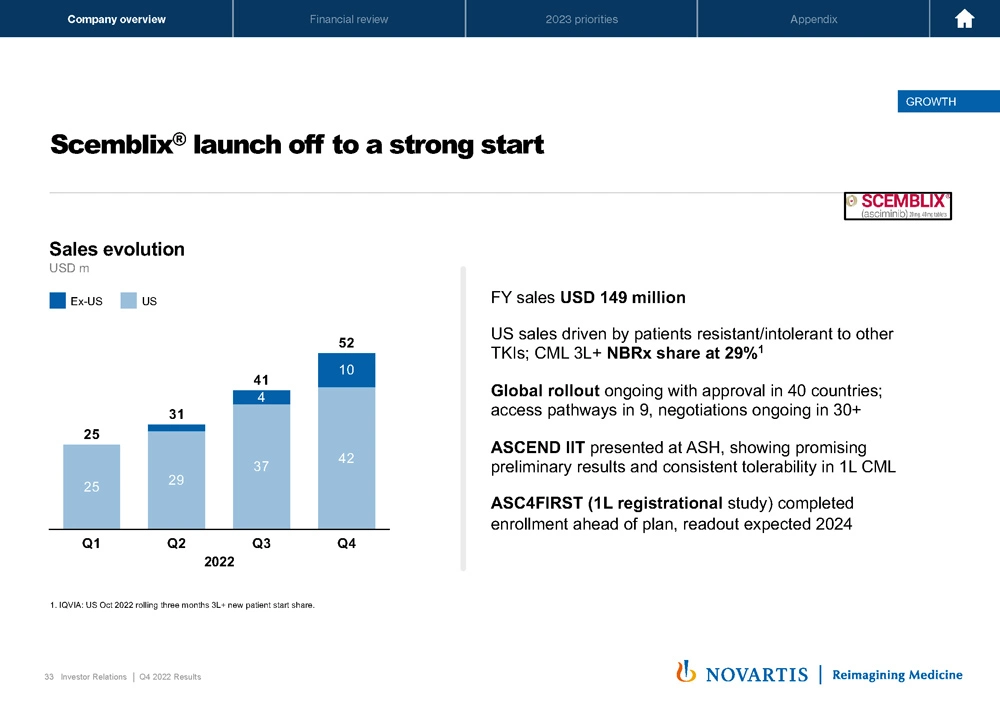

Now moving to Slide 33. Scemblix® is off also to a strong start. You can see the sales here USD 150 million on the full year, NBRx share at 29%. And probably the most important element here of this story will be the ASH preferred study, which we're enrolling ahead of plan. We expect to read out in 2024, which will enable us to potentially move this medicine in the first-line setting and potentially be used as an alternative to imatinib or some of the other first and second-generation TKIs.

Now moving to Slide 34. I'll hand it over to Harry now for the financial review. Harry?

Yes. Thank you, Vas. Good morning, good afternoon, everyone. I'm now going to talk you through some of the financials for 2022 as well as provide you with our 2023 guidance. As always, my comments refer to growth rates in constant currencies unless otherwise noted. So next slide, please.

I would like to begin by comparing our performance with the latest guidance we provided in October last year. As you can see, we generally met our guidance across the divisions and at group level, with a notable beat for group core operating income, which was largely driven by Innovative Medicines performance. As you can see, Sandoz top line also returned to growth, with core operating income impacted by higher-than-expected inflationary pressures on input costs. Next slide, please.

Taking a step back for a moment, you see that our 2022 performance was a continuation of our strong track record for Innovative Medicines. Over the last 3 years, we have delivered a 5% CAGR growth in sales and double of that at 10% CAGR on core operating income. Obviously, this performance has resulted in margin improving from approximately 33% beginning of this time period to now 37%, an increase of 480 basis points in constant currencies over 3 years. In short, we are delivering consistent performance against our financial targets and intend to continue to deliver improved financials, of course.

Turning to Slide 37. I will focus on the full year numbers on the right-hand side. For the full year, as Vas has already laid out, sales grew 4% and core operating income 8%. Operating income was down 13% mainly due to the higher restructuring costs related to the implementation of our streamlined organizational model. Net income was USD 7 billion, with the comparison versus '21 million impacted by the Roche stake divestment income. Recall, we had a onetime gain of USD 14 billion when we sold the Roche stake for USD 21 billion.

Core EPS was USD 6.12, growing 14%, excluding the prior year Roche impact. Free cash flow was USD 12 billion for the full year, of course, also impacted by the currency movements, but overall a solid free cash flow performance.

Speaking of free cash flow, let's talk about the next slide. Of course, one of my favorite year-end slides. Given our solid 22% free cash flow, we are pleased to propose the 26th consecutive dividend increase to CHF 3.20 per share. This is up 3.2% versus the CHF 3.10 last year, a dividend yield of 3.8%. Of course, this increase is fully in line with our policy of increasing our dividend per share every year in Swiss francs.

Now to Slide 39, please? Thank you. Now let's get into some further details about our 2022 margin performance by division. Overall, for the full year, core margin for the group increased 130 basis points to 33% of sales, driven by IM margin, which also increased by 130 basis points to 36.9%. And we'll talk about Sandoz in detail on the next slide.

So here is the summary of the Sandoz 2022 performance. It was a good year for the division returning to top line, with sales up 4%, driven by the biopharma growth of 9% and retail growing 4%. Core operating income was essentially flat for the full year, disproportionately affected by inflationary pressures on input costs. As we look in the future, we expect continued share gains across geographies and 2 potential biosimilar US approvals in the second half of 2023. With respect to the planned spin-off, we remain on track to complete this in the second half of the year, pending the required approvals. Next page, please.

As we anticipate a spin-off of Sandoz in the second half of the year, we thought it would be useful to give guidance for Innovative Medicines, Novartis excluding Sandoz and Novartis including Sandoz, to allow for the respective modeling that no doubt you will do. So for Innovative Medicines, we expect sales to grow low to mid-single digits, and core operating income to grow mid- to high single digits.

Novartis, excluding Sandoz, has, of course, exactly the same growth guidance as Innovative Medicines because the only difference between the two are corporate costs. Now Novartis, including Sandoz, which is essentially today's group, the group guidance is assuming here that Sandoz would remain with the group for the entire year, we would expect sales to grow low to mid-single digit and core operating to grow mid-single digit.

On the next slide, I detail a bit more the Sandoz guidance. So for 2023, we expect the top line for Sandoz to grow low to mid-single digit and the core operating income to decline low double digit. Now this core profit decline reflects the required standup investments and transition costs to separate Sandoz and some continued inflationary pressures. Clearly, with this setting, 2023 would be the trough year for Sandoz core margin given the expected added cost to stand up a public company.

Looking ahead, with respect to Sandoz midterm potential, sales are expected to grow low to mid-single-digit CAGR and the core margin is expected to expand to the mid-20s driven by continued sales growth and operational efficiencies, especially as a standalone lean generic company.

On Slide 43, I would like to add some perspectives on the other key financial elements of our expected core net income performance. In short, we expect both core net financial result and core tax rate to be broadly in line with 2022.

On the next slide, I would like to go into a little more detail about the tailwinds and headwinds facing core operating income growth in 2023. So the expected drivers of future core operating income growth include, of course, continued performance of our end market growth drivers and the acceleration of recent launches, such as Pluvicto® and Leqvio®. We also expect China growth to accelerate, benefiting from a return to normal in the second half of the year.

Additionally, our simplified organizational structure is expected to continue delivering SG&A savings. And of course, we will continue our ongoing productivity programs. Growth will be partly offset by inflationary headwinds, which are expected to continue in 2023. On inflation, some further details as we saw it in – finalizing in 2022. In 2022, the inflation impact you saw was a bit higher than expected in quarter 4. So for the total company, we estimate that the 2022 inflationary impact was approximately USD 350 million. However, this was, of course, more than offset by cost control and productivity savings.

In 2023, we expect the inflation impact to be slightly higher, also including some above-normal merit increases at approximately USD 0.5 billion. This has been fully considered in our 2023 bottom line guidance. The other headwinds are generic erosion of Gilenya® in US and potentially to Sandoz in the EU, and the standup investments, as discussed, related to the likely Sandoz spin-off. Despite the headwinds, we continue to anticipate further margin expansion in 2023 and beyond due to the expected sales growth and productivity progress.

Finally, on Slide 45. We thought it would be helpful to go into some detail regarding the currency impacts expected, especially given the significant fluctuations of the last months. As you saw in quarter 4, currency had a negative 7% point impact on net sales and a negative 9% impact on core operating. If late January rates prevail for the remainder of 2023, we expect the full year impact in 2023 of currencies to be much lower. On the top line, it would be 0 to positive 1%, and on the bottom line, slightly negative with minus 1%. As a reminder, we update this given the volatility monthly on our website. And with that, I hand back to Vas.

Great. Thanks, Harry.

Moving to Slide 47. I just wanted to make a note that we continue to focus on our goal to be one of the leaders in impact and sustainability and our approach to ESG as well as just delivering on our core purpose. 290 million patients reached with our Innovative Medicines and our global health portfolio, 453 million patients reached with Sandoz, a broad pipeline across various technology areas, numerous new drug approvals and multiple recent innovation highlights.

Just to highlight that we think the greatest contribution we make to the world is based on our ability to discover, develop and ultimately scale and launch new medicines to people across the planet.

Then moving to Slide 48. In closing, 8 priorities that will really determine our path going forward. We're transforming the company to a pure-play IM company, 5 core TAs, 5 core technology platforms and our core geographic focus is a focus on the US, 9 multibillion-dollar potential brands, a real emphasis on improving our R&D productivity towards high-impact assets and high-value assets, a focus on key TGAs and building depth in those TAs, improving our financials, as you've seen with the margin delivery and the ongoing efforts we have to continue to improve the overall financial picture, shareholder-focused capital allocation as we've shown with our dividend increase share buybacks and continued approach to how we dispose or move forward with assets such as Sandoz to our shareholders and continuing to strengthen our foundations with ESG and human capital. So with that, we can open the line for questions. (Operator Instructions)

(Operator Instructions) And the first question comes from the line of Matthew Weston from Credit Suisse.

Q. I'm going to go with a big picture question to start with, because I'm sure others will dig into the detail, it's on drug pricing. You are the incoming chair for pharma in 2023, I'd love your perspectives on whether the industry sees any success in normalizing the 9 versus 13 exclusivity to small molecules versus biologics. And also your thoughts on EU pricing pressures. There seem to be a lot of pressures building in a number of your core markets, in Germany and France and others, and also some worrying legislation in front of the European Commission. I'd very much love your thoughts given the vast exposure there.

A. Thanks, Matthew. So first, our guidance already factors in the various headwinds we see in pricing around the world. So that 4%, 40% and then also the guidance in 2023 already factors this in. So that's an important, I think, caveat. Now to your first question on – in the US, there's 3 core priorities that we have as an industry to take forward now. One is to correct the distortion of the 9 versus 13 small molecule, or NDA versus BLA. Second is a focus on PBM reform. And the third is continuing to improve the 340B program so that it can actually deliver on its intended purpose for patients in low-income settings and who benefit from various programs from federally qualified health care clinics.

Now on your specific question on the 9 versus 13, I think we have very good arguments as to why this creates an unintended long-term innovation distortion, which disadvantages small molecule and related medicines for the Medicare population, indication expansions in cancer, medicines that take longer to ramp in cardiovascular disease or in respiratory disease. So all things that need to be considered. I think the key thing will be when, in the coming years, there's a legislative vehicle for us to be able to pursue that. But it's a top priority of the industry.

And I think, at least my belief is our industry when we come together to really focus on a topic and have a very clear compelling policy case and a relatively small pay for from a congressional standpoint, that we can make it happen, and that's going to be our total focus as a sector in the US. Now on the EU pricing pressures, it's a little bit of a mixed bag. Certainly, we are concerned by some of the actions in the UK, actions – proposed actions in France. Germany has had some headwinds. But overall, the German environment, we'd say is relatively positive and workable.

But I'd say, broadly speaking, I think we as a sector need to do a better job clarifying the policymakers that in order to invest in innovation in Europe, we need a pricing environment that rewards innovation, particularly when it improves the outcomes for patients. And this can be seen as a place to constantly cut costs, especially relative to the rest of the world. So that's going to be our focus to try to educate. But for us, I think Germany remains the most attractive market. And therefore, I think from a financial outlook standpoint, we feel comfortable with the guidance that we've given. Thank you, Matthew. Next question, operator?

Your next question comes from the line of Graham Parry, Bank of America.

Q. So it's on Pluvicto®. So it's now annualizing in over USD 700 million, which I think was pretty close to your peak guide for the VISION-labeled indication. So is that a steady state number? Or can you see growth expanding from this quarter-on-quarter? So have you hit your supply capacity constraints now until you get more supply coming online? And could you just underestimate the VISION population here, given it's penetrated so quickly?

And then on your capacity into next year, you said that the number of doses around 250,000. Correct me if I'm wrong, that would equate to around 50,000 patients, which is over USD 8 billion of revenue potential at US prices. So perhaps just give us a feel for what you think the top peak numbers for this drug could be in the context of the 2 billion that you've been putting into the slides for PSMAfore and PSMAddition.

A. So first, I think from a demand standpoint, I would say our initial estimate of the VISION population have underestimated the potential of this population and the demand would suggest to us that there are a greater number of patients and providers interested in this medicine. So we certainly have not fully penetrated the VISION population in the United States. And really, it's a question of us continuing to expand our capacity to meet what is the much larger interested population than we initially expected. And so we're working towards that.

As I mentioned, we're working with multiple sites to have online over the course of this year. Ideally, and if according to plan by the middle of this year, but that's dependent on regulatory action and then additional sites towards the end of this year as well. So we would expect if we can meet the demand that there will be continued growth from the VISION population in and of itself. Now I think beyond that, with the PSMAfore, PSMAddition, we certainly see this medicine becoming a very significant medicine for the company, assuming the data reads out positively over the coming readouts.

That will take, of course, the readouts have to come through, but we're preparing from a capacity standpoint to have this be a very large medicine for Novartis. And you see that – I also mentioned we're preparing as well as to add additional facilities in Asia. We have advanced already planning on those 2 additional facilities. So we'll be ready to make this medicine around the world available to many prostate cancer patients as we can.

Q. And so just to be clear, have you reached capacity already? Or is there further capacity that you can still fill with increased demand?

A. We have further capacity versus Q4, but we certainly need to continue to work – to further expand the capacity given the size of the opportunity, the size of the demand that we're seeing. We have some limited additional capacity versus Q4, but we need to expand further to fully meet the demand for sure. So I think from how you model this, I think in the first half of this year, it should be modest growth as we work to expand the facilities. And then assuming we get the facilities online, we would hope a ramp up then in the second half as those – that additional capacity comes online. And then moving into next year, of course, we have the additional capacity, additional geographies and then, hopefully as well, the PSMAddition population as well.

Operator

Your next question comes from the line of Stephen Scala from Cowen.

Q. We noted that the Phase II data for your obesity agent, MBL949, is due in May. I don't believe Novartis has stated the mechanism other than it's not an incretin. Can you confirm that it targets Anti-ACTR3? And is it the same as or similar to the molecule you previously out-licensed? And I'm also curious on the same topic, why you didn't highlight it on Slide 20? Are you not excited about this target? Or are you not excited about obesity?

A. Yes. I can say definitively, it's not related to BYM, the molecule that we out-licensed. We are not disclosing the mechanism of action. You are correct that we do expect the readout in quarter 2. And the simple reason we didn't highlight on the slide is we view it as a high-risk, high-reward program. Now they're all high risk, high reward, but I think particularly for agents of obesity, the key is can we find a dose and schedule that leads to both profound weight loss and a tolerability profile. And I don't know – I've not seen the data, so I don't know. But I mean, that's the key question, and that's why we didn't – chose not to put it on the slide until we have further data, which we'll have in the second quarter. And then, of course, we'll provide an appropriate update at that time.

Your next question comes from the line of Tim Anderson, Wolfe Research.

Q. On Cosentyx®, what's driving the higher Medicaid channel mix? And could that somehow increase further? Or might it actually reverse out as Medicaid enrollment numbers potentially shrink with the US declaring that the pandemic is over? And then an update on formulary positioning in '23 in terms of lives covered and a preferred spot. And also, if you can comment on whether there's any new access restrictions and what the rebating was like in '23 relative to prior periods?

A. Yes. Thanks, Tim. All great questions. So first, on the Medicaid increase. First, it's important to note with a brand like this, USD 3 billion of net sales, significantly more gross sales, the actual percentage variation here is not huge. Nonetheless, we don't have a great handle on why exactly the Medicaid came up a bit more. But one of the drivers with certainly, we had certain special higher discount agreements with certain Medicaid plans. Those have now expired. And so those would no longer be in play for the coming years.

And so I think overall, we expect to see the mix goes up and down year-to-year. But overall, we expect to see the mix stabilize back to what we've historically seen prior to this situation we had in 2022. In terms of formulary, it's largely in line with what we had in 2022. We see no significant shifts or changes in terms of formulary position, access. Overall, given the overall scheme of things when we look at gross to net, they're in line with 2022. So that's why we'll feel good in the US that on an annual basis, we will be able to deliver sales that are in line with what we saw – in 2023 with what we saw in 2022, and then the growth would come from the new indications.

Again, I just want to highlight that for the first half of this year, because of the fact we took all of that Medicaid charge in Q4, and when you lap the prior years, the base is not fully adjusted. So you are going to see a lower relative Cosentyx® sales in Q1 and Q2 because of the base effects of taking all of that Medicaid rebate into quarter 4. But I think the bigger picture on this brand is our ability to deliver new indications, new formulations. That's really where we have to focus. And then the continued expansion in Asia and China as well as in Europe.

Your next question comes from the line of Florent Cespedes from Societe Generale.

Q. On Slide 30, on Leqvio®, there is a chart showing the sales that – and the Entresto® sales as well, the mostly sales. Do we have to understand that the Leqvio® should continue to trend with the same pace as Entresto®? Or, as you suggested last year, we should see an inflection later this year given the fact that we expand the number of sites that could prescribe the product? So some color on that would be helpful.

A. Yes. I think we just want to overall indicate that the launch is in line with other major cardiovascular launches, where we've been able to generate very large medicines, and you've seen how Entresto® continues to perform. I don't exactly – we continue to hope for the inflection point certainly in the second half of the year. It's hard to predict exactly when it would happen. There are a few things that give us confidence. We should see some acceleration in the back half of this year. One is the free trial offer program that we had rolled out will expire, and we hope that those patients will convert into paying patients in the second half.

Second, with that 7,000-plus physicians that I mentioned, we expect to get greater depth in those physicians over time, which should also drive greater growth as well. We also see an increasing comfort with buy and bill versus the alternative injection centers. And as that happens as well, we generally see physician sites prescribing more of Leqvio® because they can do it in-house without having to refer a patient out. So all of those would be the positive tailwinds we would see towards the second half of the year.

I think broadly speaking, we feel comfortable with where consensus is on Leqvio® for the full year 2023. And then our goal remains to make this into a very significant multibillion-dollar medicine over the coming 5 to 10 years.

Your next question comes from the line of Peter Welford from Jefferies.

Q. I have a question on oncology. Just obviously, there was a lot of emphasis on radioligand therapies, and that was highlighted some of the new and upcoming ones you have as well that are coming through Phase I/II. There are relatively few other sort of priorities in oncology highlighted within the pipeline. And so I wonder if you could still say, first of all, if you just sort of view your KRAS and the opportunity there, given also what we've seen develop in that market, but also ociperlimab, is that now discontinued? Or is it just delayed that you continue to evaluate TIGIT? And sort of more broadly, is this still an area which you could see further business development? Or do you think this is an area obviously less focus from Novartis?

A. Yes. So I think on oncology, I mean, it remains a huge focus for the company. 40% of our R&D budget is focused on developing the next wave of oncology medicine. Within solid tumors in addition to the radioligand therapies, where we have now a growing portfolio across neuroendocrine, prostate, we have a range of other indications we're taking Lutathera® into – we have the anti-Integra, the bond basin. We recently are hopefully bringing in a folate as well. So we have a broad portfolio within RLT where we see a significant opportunity.

We continue to also pursue the TIGIT through the deal we have with BeiGene, and we have that as an option deal. We also are assessing what other lines of therapy to take that TIGIT into given the competitive landscape, that's something we're actively evaluating.

And then in terms of other active programs that are in Phase III, certainly the KRAS and the KRAS G12C are continuing. Our overall perspective is a critical thing now is to demonstrate efficacy in a combination setting. We think we've seen now from the sales performance of the mono G12C inhibitors. While important for a certain group of patients that have the mutation, much more important is can you ultimately demonstrate tolerability and efficacy of the G12C with a PD-1, with a SHP2 with other agents. And that's something that we're working through to see. And that would really, I think, give us more confidence that this could be a very significant medicine.

Now earlier stage within the NIBR portfolio, we have a range of different assets that we're pursuing. We have a few targeted protein degradation agents that are advancing now into Phase I/II, a couple of novel targets in non-small cell lung cancer as well as other solid tumors. So that whole space continues to progress. As you know, oncology has a high level of failure rate. So I don't want to oversell it, but I think we're certainly working to continue to find the next wave of solid tumors.

And then we active – are active in the BD&L space. And I think if we could find attractive assets within our core cancers: lung cancer, prostate cancer, the gastric GI cancers, et cetera, those are certainly things we would actively look at. I would say in hematology now between Scemblix®, iptacopan, ianalumab, we have some pretty – building on the legacy, of course, of Glivec®, Tasigna® and Promacta®/Revolade®. We have a pretty good portfolio in hematology. And then, of course, with now YTB moving into the first-line setting in large B-cell lymphoma, it's a nice portfolio to continue to keep – maintain our strength in hematology over time.

Your next question comes from the line of Seamus Fernandez from Guggenheim Securities.

Q. Great. Thanks for the question. So can you maybe just give us a sense of what the team is doing to extend the IL-17 franchise beyond Cosentyx® exclusivity in 2029? There's obviously a number of high-value immunology assets out there in development. We're just interested to know what Novartis is doing beyond that. And maybe if you could, would you mind commenting on how you see the HS landscape evolving going forward, given some of the data that we've seen for bimekizumab and then potential competitor (inaudible) as well.

A. Thanks, Seamus. So first on IL-17A and the Cosentyx® portfolio overall, of course, I think we're actively working on and looking at Cosentyx®, LOE 2029. We have additional patents that go into the 2030s, which will, of course, actively prosecute as well. We have a range of oral anti-immunological agents we're pursuing in-house. So oral IL-17A and as well as other oral agents. And of course, actively looking at external opportunities as well in that space, if we see compelling data. So I think I think that's going to be really critical for us to look at. But of course, we have time and something we'll work through over the coming years.

I also would say that in immunology between ianalumab, remibrutinib as well as other programs we have now advancing through the pipeline, we're also prepared to pivot not to be – not just focused on psoriasis, PSA and AS, but also try to move into – really be a leader in areas like Sjogren's, SLE and other immunological illnesses, as you mentioned, like HS. For HS, our view is that our 52-week data is very compelling. We think this will really be a space where a long-term data is what really matters. We think our 52-week data relative to the TMF are very good. We're aware of other IL-17A is coming.

I think what's important to note is this is a very, very undertreated patient population. These patients generally have given up and generally are not coming in for therapy. So the real opportunity here is to get these patients to know that there are better therapies available, and that will create, I think, a large market opportunity, where multiple players can be successful Given that these agents are looking like they have better efficacy and safety than the anti-TNF anything to say about other mechanisms at the moment. In-house are pursuing other mechanisms as well against HS to try to make sure that we cover our bases. We have evaluation of our anti-CD40 ligand, we're evaluating remibrutinib, our BTK inhibitor. So we have a range of efforts looking at HS, and of course, we'll see which ones pan out in-house. (Operator Instructions)

Your next question comes from the line of Andrew Baum from Citi.

Q. Question is on Pluvicto®. Looking at your patient access, Vas, demand clearly materially exceeds supply currently for the product in the US. Could you just outline your confidence of FDA approval for the mid and end year for the new facilities? Just given the recent track record of Leqvio® plus you have a new facility, what is the risk of that dragging on? And connected to that, how should we think about the future competition from POINT and Lantheus with their (inaudible) in prostate?

A. Yes. I think with respect to the files we're ready to file, the site and we're in discussions with FDA to have filed the Millburn site. And the time we get the okay to file, there's a 4-month review clock for that additional facility.

Our Indianapolis facility with multiple large-scale automated lines, we plan to file in quarter 3 as well to the NDA. And again, it would be an addition of additional sites. So we would expect a 4-month approval time. And so we're doing everything we can to make that a reality. And we plan right now for those sites, our base plan is for those sites to come online this summer and then later on this year. And then we'd have adequate supply to fully meet the demand of the VISION population as well as the PSMAfore population.

Now I think in terms of the competition, it's important to note this is extremely difficult manufacturing. This is a just-in-time manufacturing that requires really logistics expertise. We currently source the entire US market out of an Italian site and do it successfully. And we believe we've built up substantial know-how and expertise with the relevant sites to give us a strong competitive position. Now other players, of course, are going to come in and try to launch. The question will be do they have the same scale and expertise that Novartis does to be able to navigate that complexity and really ensure that they can meet the demand.

So that's kind of our outlook right now. We feel good about – by the middle of this year, we'll be in a very strong position to meet the supply. I would also note for Leqvio®, because I noted your comment on that product, I mean, we have a large-scale line now that's up and running in Switzerland, which makes us the largest producer of siRNAs in the world. So I think we're good on gene therapy, RLT and siRNA manufacturing. We feel very good with the approach we've taken. And I think we're in a very good place on all 3 of them.

Your next question comes from the line of Keyur Parekh from Goldman Sachs.

Q. One big picture one for you've, Vas. With the proposed separation of Sandoz, kind of Novartis will become a focused innovative medicines company. Once that transaction is done, are you done with kind of the process of changing the shape and structure of Novartis? Or do you think there is more kind of you want to do relative to the size and the shape of the Innovative Medicines company that will be left at the end of the Sandoz transaction?

And just kind of linked with that, I know kind of Ronny team has been hiring kind of the higher – kind of some people like Dr. Yang, et cetera. But just more broadly, how far along the process of building that kind of growth and strategy functions set under Ronny is kind of Novartis today? When do you think that might be done?

A. Yes. Thanks, Keyur. Broadly speaking, our strategy was to get to become a pure-play Innovative Medicines company, design the company in the right way. We started that journey in a principled way 5 years ago. Of course, there was a pandemic for 2.5 years in the middle of that, so it got a little more complex. But I think we have the right set up post the Sandoz spin with a geographic focus on the US and ex US and from a commercial standpoint, really committed and renewed leadership in R&D and then the strategy and growth function to really identify external and internal opportunities that can drive the growth.

So I think post that time period and post seeing through the transformation program we announced last year and the relevant restructuring, I think we'd be then in a position to really just focus on execution. We need to execute on our launches, execute on our pipeline, execute on our productivity, continue to generate that mid-single-digit sales growth and that attractive core margin over time. And then that becomes the core of what we do day in and day out, continuing to look at attractive external assets to add on over time.

Ronny team is getting built out, I think, off to a strong start. A much more integrated – the most integrated approach now that we've had that I'm aware of, at least in 20 years, is the R&D portfolio management, it all falls under one roof now in terms of how we look at the R&D portfolio, an integrated approach to taking commercial input into the earlier stages of research, much more focused on key TAs and being much more disciplined in saying no to projects that are of strategy. So I think all of that's coming together, it's been 4 or 5 months for Ronny, it's been 2 months for Fiona Marshall, but I feel really good that this is a great team that can deliver that innovation horsepower we're going to need as a pure-play company.

Your next question comes from the line of Emily Field from Barclays.

Q. I just wanted to ask a question about iptacopan. This US filing in the first half of this year include both PNH trials. And then – because I know you mentioned that you're running the switch study for the frontline patients as well. Just trying to get a sense of commercialization strategy across the PNH spectrum. And then just I know you have BTD for this asset, just how long of a regulatory review you might be expecting?

A. So with iptacopan, yes, we'll be following both studies, both the refractory and frontline study as part of the package, and that's aligned with FDA. We do have used a priority review voucher as well for this asset to really ensure that it's approved in a rapid time frame. Even though we had breakthrough therapy designation, we don't want to take any risks with respect to this particular filing to make sure that it happens as fast as possible.

With respect to our overall strategy with iptacopan, when you look at this market, we believe that it's 60% to 70% of patients who, on current anti-C5 based therapies are not adequately controlled, and those patients could be switched to iptacopan based on the data we presented at ASH and assuming the final label supports it. And so that's a substantial opportunity for the medicine. We know that potentially up to 60% to 70% of diagnosed PNH patients are not on a therapy today. And they come on, I think, in a few different categories. Some are subclinical or not quite clinically severe enough. And the question is with a twice a [day] safe oral, is there an opportunity to get more of those patients on therapy because it may be physicians or patients were holding off wanting to be on regular infusions. So could an oral therapy open up that market.

I think there's a set of patients also who have gone back to taking transfusions, having now failed prior therapies. That's another opportunity. And then there's probably a set of patients as well that are just in the watch and wait mode. So that will be an opportunity for the medicine as well. So we think there's multiple places. It will take us time to drive this launch. So this will not be fast given the strength of the incumbent position. And then also that this – a significant group of patients not on therapy has to get mobilized.

And we believe over time with the compelling data that we have and the recognition that a twice-a-day oral could be a really compelling option, we can build a very significant medicine on PNH, then expand into C3, IgAN, aHUS, IC-MPGN and then subsequent indications thereafter.

Your next question comes from the line of Richard Vosser from JPMorgan.

Q. Just going back to Kesimpta® and obviously, very strong. We're going to see another launch for another CD20 this year and coming around now from TG Therapeutics, obviously an IV, but lower price. How do you see that impacting Kesimpta® this year? And maybe also we're going to see subcutaneous data, how do you see that as well in the future around the launch?

A. Yes. Thanks, Richard. So the way we look at the MS market, the one, as I mentioned, you have 50% of patients that are not on B-cell therapies and 50% on B-cell therapy. So there's a substantial market opportunity just to get more patients in the first-line, first-switch setting on to high-efficacy B-cell therapy. So there's plenty of room for growth just for Kesimpta® and getting some more of those patients.

The second thing based on our understanding of the market is that there are sets of facilities and health systems that prefer infused medicines, and there are those that prefer providing patients subcu medicines. And we see those as very stable. So really, this market is a split market. You have a market of physicians who want to give infused medicines and there is a large proportion of the market who want to give patients the opportunity to have at-home subcu administration. Within that subcu, we don't see any at-home administration relevant competition for the coming years, and that's very much our focus area.

Within the IV segment, there is now competition and I think that competitive dynamic will be an important one for us to observe. And I think to your point, Richard, will the opportunity of having subcu physician-administered medicines expand the number of centers that might be interested in a physician-administered approach, we don't know. Nonetheless, the market opportunity ahead of us, with the 50% of patients not on B-cell therapies and the substantial number of physicians who prefer providing an at-home administration, that's the opportunity for this medicine, and that will give us plenty of room to grow over the coming period.

Your next question comes from the line of Simon Baker from Redburn.

Q. Just going back to Leqvio®. Vas, you briefly touched on buy and bill. I just wonder if you could give us a little bit more detail on the progress you're making there. I ask because, on one hand, there was a fairly negative article earlier in the month on Leqvio® buy and bill but on the other hand, we see in September and December last year, quite a significant uptick in traffic to the Leqvio® access website. So I just wonder if you could give us the latest picture there.

A. Thanks, Simon. Look, there's no question that buy and bill is a new approach that cardiologists need to understand and get implemented to their office. That said, we know there are many specialties that have successfully done that, ophthalmology, oncology, rheumatology, neurology. So this is something that can be done. Is it – does it take time? Yes. Do you have to work through many hurdles? Yes. Do you have to get all the staff to understand a new approach? Yes, absolutely, but it can all be done.

And as I noted, now that we have over 7,000 physicians that have taken action on Leqvio®, 1,800 facilities ordering Leqvio®. A steady increase in conversion from facilities that were previously using alternative injection centers to now implementing buy and bill in their facility for Leqvio®. I think we're getting to a place now where physicians are getting more and more comfortable with the concept. And what we generally see is once a physician has one patient go through the process and they understand that it is something that's manageable, then it becomes something relatively straightforward for their office and then they take it on relatively quickly.

So we have to get up that curve, but we're seeing, I think, positive trends. And we'll just keep working through it, keep also hopefully having clinics be able to educate one another about the experience of how buy and bill ultimately works and get that further implemented. So I wouldn't read too much. And you can always find probably a physician to tell you any process is onerous and terrible. But I think broadly, when we look at a large-scale data set, we see steady progress on this front.

Your next question comes from the line of Michael Leuchten from UBS.

Q. A question for Harry, please. Just going back to the Sandoz operating expenses into 2023. I mean that's the biggest delta that your consensus really looking at the composition of numbers for this year. Harry, how much of these expenses are standup costs and how much is sort of prepping for manufacturing shift as well? This just seems a meaningful amount that is coming into the P&L. Is that purely just separation costs? Or is that already including sort of longer-term expenses that already hit 2023?

A. Yes. Thank you, Michael. So overall, I would say, if we take out these standup and transitionary costs, the core operating in Sandoz in '23 would be flat. So it's a low double-digit decline comes from that. If you think about, right, Sandoz delivered USD 1.9 billion core operating income in '22, so we talk about roughly plus/minus USD 200 million of cost block. Out of that USD 200 million, about USD 70 million to USD 90 million will be real standup costs, corporate costs and so on that Sandoz needs to operate as a separate public company. And the other half, if you will, will go away over time, as the fully transitioned to a public company. That would naturally go away as these transition costs are not any more needed over – after a couple of years.

Of course, also the corporate cost – there will be corporate costs. But clearly, Sandoz has plans to reach in the midterm the mid-20s margin by then streamlining the overall operations, SG&A structures as they are a stand-alone company. So I hope that gives you a bit more flavor on that guidance for this year, which really should be a trough year. And then after the separation, relatively quickly come off that, including, of course, taking over transitional service costs, like for IT over time, quite quickly, usually maximum 2 years on such services.

Your next question comes from the line of Emmanuel Papadakis from Deutsche Bank.

Q. Perhaps I'll take one on Kisqali®. You've reiterated the over USD 3 billion pre-sales potential for the edge of an indication. So perhaps you could just help us understand how important do you think a clinically meaningful benefit in both of the 2 key subpopulations in the trial as intermediate risk and higher risk in terms of realizing that potential that is positive? And how would you define clinically meaningful in terms of the absolute relative DFS benefit in that population? And indeed, is that something you actually disclose with the headline or have to wait until details are presented?

A. Yes. Thanks, Emmanuel. So the trial right now is overall designed for an endpoint across both patient populations. And so there – in order to hit the primary endpoint, we need to hit across all populations. Now the question would be, would FDA parse the data and say that it was driven by the high-risk population and then potentially take a different approach, we can't judge. But the way designed and powered the study is across the entire group. And so from a prespecified analysis on the primary endpoint, it would be for both the intermediate and the high risk, of course, with the relevant secondary end points.

I'd also note that we've aligned with FDA that key for us is to show no detriment in OS, as long as we can demonstrate no detriment in OS at the time of that readout, that would be the case. So I think you could expect a headline on, whenever it comes, on the IDFS. And then if relevant OS or not relevant the – we would not say anything on the OS. And then we'd have to have the discussion with the agency to determine how they would like us to cut the data. From our competitor data, there was a threshold that was applied for a certain subpopulation Ki-67 and then later adjusted. So these are all things that we'll have to determine as part of the review process.

Your next question comes from the line of Mark Purcell from Morgan Stanley.

Q. It's Mark Purcell from Morgan Stanley. On iptacopan, first, could you help us understand, when you say the 9-month analysis could potentially support US Subpart H filing, how should we think about the sort of probability of moving forward at that point versus, obviously, out just of 2025 or so and slowing progression of IgAN before you can approach the FDA with your package?

And then sort of related to that, obviously, a much bigger population in IgAN versus PNH and C3G, aHUS, et cetera, should we think about sort of population of the 185,000 patients you estimate with IgAN, which would be a target hill? Or would you sort of launch this as a completely separate brand? I'm trying to think about what Novartis' broad ambitions might be to build out a portfolio of primary care and rare renal assets given your commercial capabilities across the platform.

A. Yes. Thanks, Mark. So first on the endpoint for IgAN. We saw in the Phase II data, Phase IIb data, I think (technical difficulty)

... reduction in proteinuria across the very statistical analysis that we've done. And that's the basis for us designing the Phase III study. So we feel good that if we hit the required slope of reduction that we target that, that would allow us to file with the FDA. Though I imagine it will also come down to the totality of the data. But certainly, our base case is that if we hit the primary end point on proteinuria, that should give us the basis to file. And then of course, we would look at eGFR and other endpoints in 2025 that would be more meaningful after further follow-up. Broadly speaking, for our Factor B (technical difficulty)

... focus on PNH, C3G, aHUS, IC-MPGN, called the gluten disease and the related spectrum of illnesses, when we're in a more common illness like IgA nephropathy, our focus is on more severe patients to be able to maintain the ultra-rare pricing. We do have follow-on Factor B inhibitors that we plan to take forward in broader indications. You'll know that we do have a program for iptacopan evaluated in geographic atrophy and related retinal diseases. And if successful, we would actually use the backup compound for those broad indications, and that's how we're thinking about splitting out across the whole factor B enterprise.

Your next question comes from the line of Richard Parkes, BNP Paribas.

Q. It's just another one on Pluvicto®. You've outlined obviously, you'll have manufacturing capacity to allow you to address the majority of the PSMAfore population by 2024. Could you talk about the other hurdles and limitations on your ability to penetrate that population, including referral patents, proportion of patients care in the community and access to nuclear medicine facility, just so that you can help us scope out the opportunity?

A. Yes. Richard, what we've seen thus far is there's about 500 facilities we believe we would need to be able to provide Pluvicto®, at least in the US market, to reach the demand – the potential basin population across the 3 indications that we have. We're able to – currently servicing a little over 200 of them, and we expect that to expand over time. I think what's going to be the next challenge because the demand, as we've noted throughout the call, much higher than we expected, and I think folks on the call expected, frankly, is actually having – the centers have enough infusion chairs to be able to provide the therapy to enough patients.

So that's the next constraint beyond once we believe our supply constraint later in the middle of this year to then work with the centers to have a better estimate of what the number of patients they think they will need to provide radioligand therapy to a day and ensure they have adequate chair or bed capacity to be able to do that. Because I think that will be, as we get into broader and broader patient populations, that will be the next constraint we'll have to then work through. There seems to be a lot of enthusiasm in the urology and nuclear medicine community to do that, so I expect it will happen. But that's something we're going to have to work through over the coming quarters.

Just opening Steve's line.

Q. I assume you're calling on Steve Scala. So I'm just wondering, what is your specific assumption for the profile of Merck's oral PCSK9 for which data is coming very near term, in terms of both its LDL lowering and its safety? I assume your view is very cautious, which supports your high enthusiasm for Leqvio®, but what sort of role do you think an oral PCSK9 ultimately could have in this marketplace? .

A. Yes. Thanks, Stephen. I'm glad you asked that question. Our view – and we had an oral PCSK9 program, which we've deprioritized. We are pivoting cardiovascular research into – in Novartis and to infrequently administered siRNA, ASOs, et cetera, to get to – first, as you know, we have PCSK9, we have combination programs, of course, we have Lp(a), follow-on programs with various combinations. And the goal would be to say, can you get to combinations at 6 months or long-acting at 1 year, with the belief that over the last 25 years, we've learned that compliance to orals in this market is low. Statins are 30%, other therapeutics are in a similar range.

And if we really want to tackle cardiovascular disease scale, we need to get to infrequent administration. So we have Leqvio® as a starting point. We're going to work very hard to extend past – not get the 9 to 13. But we're anyway going to have life cycle management working on long-acting Leqvio®, working on combinations with Leqvio®. And our goal will be very much to have a combination siRNAs that can cover the relevant mechanisms of action for cholesterol lowering, so that patients won't need oral drugs anymore. Because we think that's where medicine is heading and we think that's what siRNAs, long-acting ASOs and similar technologies can deliver. So hence, we deprioritized oral systematically on cardiovascular at Novartis and focus on this next wave of technologies and therapies.

All right. Very good. Thank you all for joining, and we look forward to updating you further at quarter 1. Take care.

Disclaimer: The information in the presentations on these pages was factually accurate on the date of publication. These presentations remain on the Novartis website for historical purposes only. Novartis assumes no responsibility to update the information to reflect subsequent developments. Readers should not rely upon the information in these pages as current or accurate after their publication dates.